california nanny tax rules

You cant claim a nanny on your taxes but you may be eligible for the child and dependent care tax credit. No you are not required to register report employee wages or withhold or pay any California payroll taxes because the cash wage limit of 750 in a quarter has not been met the value of.

Printable Partnership Agreement

If you employ a household worker - nanny.

. Ad Ideal For Busy Families and Budgets. Additionally hours over 12 in a. This fact sheet contains information you need to know to comply with state and federal labor and employment tax laws - the so-called California nanny taxes.

While federal laws cover employers in all states there are state- and city-specific nanny tax rules and regulations that families must also follow. Nanny tax rules household employment rules wage and hour law and payroll tax requirements are governed by a complex assortment of Federal state and local rules and legislation. To claim the credit the qualifying child must be under age 13 and.

Hiring a domestic employee in California or have questions about complying with the states tax wage and labor laws. You are not required to register report employee wages or withholdpay any California payroll taxes because the cash wage limit of 750 in a quarter has not been met the value of meals. Bloomberg BNA recently rated California one of the three most complicated states for employer compliance with payroll and labor laws.

Get a free no-obligation consultation with a household. Overtime at 15 times the hourly pay rate is due for hours over 8 in a day or over 40 in a 7 day work week. A household employee is someone who does work in or around your.

Pay the employers portion of. Ad CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations. Easy Tax Preparation Management.

This fact sheet contains information you need to know to comply with state and federal labor and employment. Nanny Household Tax and Payroll Service. Ad CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations.

To claim the credit the qualifying child must be under age 13 and. The nanny tax rules apply to you only if 1 you pay someone for household work and 2 that worker is your employee. Nanny Household Tax and Payroll Service.

Come and go live-out general household workers. Fill out Form W-2 if you pay wages of 1000 or more and give Copies B C and 2 to your nanny. The state often refers to these rules as the California nanny tax obligations According to the law household employers have four primary responsibilities.

Click on a state on our Nanny Tax Wage. Families even the most well. California nanny tax rules Thursday March 10 2022 Edit.

California nanny tax rules Thursday June 9 2022 Edit For someone in the 24 federal tax bracket this income reduction means saving 240 in federal taxes for every 1000.

California Domestic Worker Bill Of Rights Employer Facts

California Domestic Employment What Families Need To Know

How To Do Your Nanny Taxes The Right Way Marin Mommies

Tax Law 101 A Helpful Guide For Ca Household Employers Educated Nannies

Simple Tax Tips For Families With California Babysitters California Babysitters

Limited Partnership Contract Template Contract Template Limited Liability Partnership Partnership

Free California Labor Law Posters For 2022

Free California Labor Law Posters For 2022

California Durable Power Of Attorney Form Power Of Attorney Form Power Of Attorney Attorneys

How To Do Your Nanny Taxes The Right Way Marin Mommies

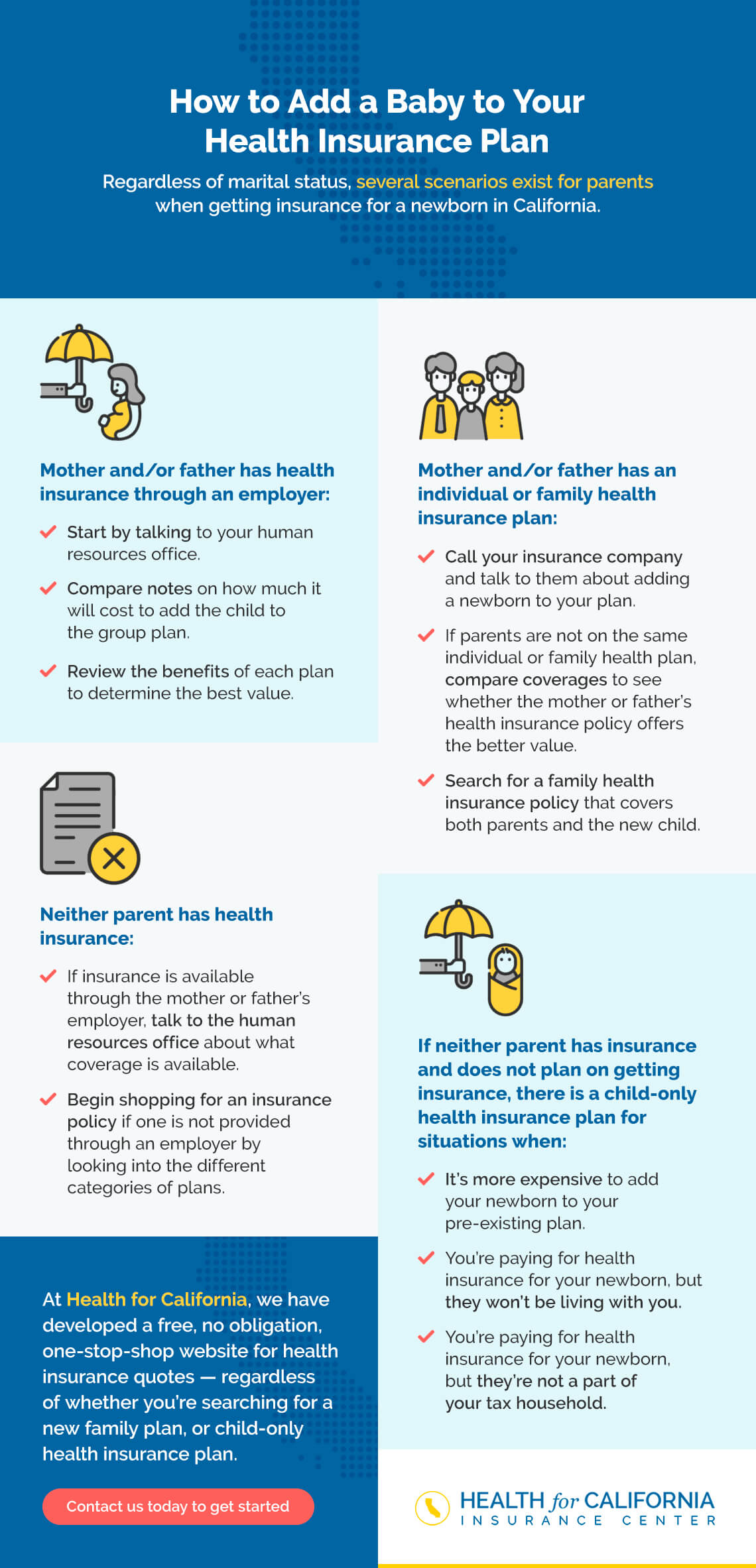

Newborn Baby Insurance In California Hfc

Nanny Tax Wage Labor Laws By State

Can I Report My Employer For Paying Me Under The Table In California Workplace Rights Law Group